Plant-based, cultivated meat and fermented products could account for as much as a third of the meat we eat by 2040, but achieving such growth depends on effective government policy, a think tank finds today

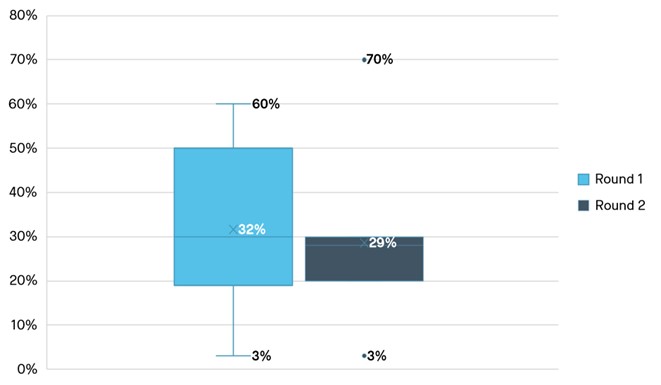

The Social Market Foundation – a cross-party think tank – collected a range of expert predictions, which produced an average estimate that alternative proteins (APs) could capture around a third (32%) of the UK market for meat (See notes – Figure 1). That could save more than 300 million animals from being raised in factory farms and slaughtered every year, the SMF estimates, alongside potential benefits to human health and the environment.

At the same time, the research highlights the huge uncertainty that remains over the future of the alternative proteins market. While all but the most pessimistic forecasts suggest more people will be eating alternative proteins in future, estimates for its future market share range vastly from 3% to 70%.

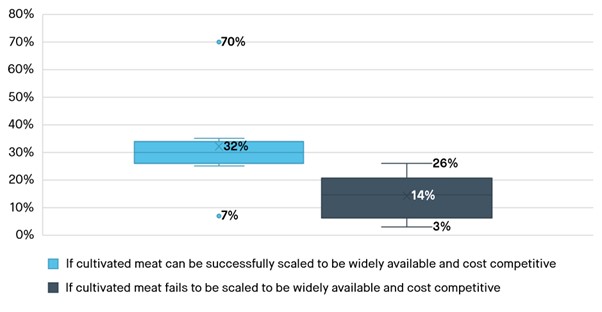

SMF analysis suggests that improvements in cultivated meat (products derived from animal cells) production to become cost effective at mass scale will be critical. Without this, experts believe that alternative proteins’ market share will only reach 14%, rather than 32% (See notes – Figure 2).

Whilst the UK is a European leader in alternative proteins (second in sales, third in terms of per person spending on APs), the industry’s momentum has been disrupted by stalling growth and investment.

The SMF says that turning it around will depend mostly on the investment and innovation of alternative protein producers to refine their products and make them cheaper, but that government policy also has an important role to play. Streamlining regulation to make it quicker and easier to get new products on the shelves should be a particular focus – 88% of experts said this would make a very significant difference to the success of the market.

The US and Singapore allow cultivated meat to be sold to consumers, albeit products that are some distance from being widely available at affordable prices. An Israeli cultivated meat manufacturer, Aleph farms, recently applied for approval in the UK. Aleph expects the review process to last between 12 and 24 months. This extended timeline could be reduced by a better resourced Food Standards Agency, reducing unnecessary and politically motivated hurdles, and further reforms to the regulatory process itself, the SMF notes.

The government can also support the alternative proteins sector by stepping up investment in public research to support improvements in AP products, the SMF noted. The Good Food Institute estimates that it will cost £78 million a year in investment for the UK to compete with countries like Denmark, the Netherlands and Canada, which are seeking to become ‘alternative protein superpowers’. Such public investment is risky, the SMF cautions, but worthwhile, given the huge potential benefits of ‘clean meat’.

Previous SMF research has found that the majority of people (58%) have taken steps to eliminate or reduce their own meat consumption. Whilst a significant portion of people were dissatisfied with the current meat alternatives on offer, 62% would support public investment in alternative proteins research, the SMF found.

Aveek Bhattacharya, Interim Director at the Social Market Foundation, said:

“The potential benefits of alternative proteins are enormous – producing tasty, nutritious and cheap food, without the horrendous costs to animal welfare and to the planet that factory farming currently involves. Whether it can fully deliver on that promise remains uncertain, but that is almost always the case with exciting new technologies.

Plant-based alternatives have already gained a good foothold in many people’s diets, but they need refinement and improvement if they are to fundamentally disrupt the meat industry. Cultivated meat could be a game changer, but at this stage it is hard to know whether it will turn out like solar power – widely adopted and affordable – or like nuclear fusion – always tantalisingly just out of reach.

The Government should ensure regulation does not smother the industry, and can support it with judicious investment. If successful, hundreds of millions of animal lives can be saved, and we will be that much closer to meeting our environmental obligations.”

Gemma Hope, Assistant Director of Policy, Advocacy and Evidence at RSPCA, said: “It is incredibly exciting to think that 300 million animals could be saved from suffering on an industrial scale in intensive farms as a result of the growth in alternative proteins. Intensive farming is the biggest cause of animal suffering in the UK and around the world and we must find ways to create a kinder farming system.

“We ultimately want to see an end to intensive farming and alternative proteins offer huge opportunities to move towards this and change the lives of animals. We know that alternative proteins are better for the planet, can be better for our health and they are better for animals but we need government and industry to have the will to invest and support development of this market to make these changes a reality.”

Notes

- The SMF report will be published at https://www.smf.co.uk/publications/alt-proteins-animal-suffering/ on Monday 13th November, 2023

- The report is sponsored by Royal Society for the Prevention of Cruelty to Animals (RSPCA). The SMF retains full editorial independence.

- Research methods: This report draws on 10 semi-structured interviews with people who either work directly in the alternative protein sector or have a significant professional interest in it. Among the participants, some are actively involved with alternative protein companies to contribute to the market’s development, while others serve as more distanced observers or researchers. Interviews took place during July and August 2023.

Figure 1: “What share of the global meat market do you expect alternative proteins to make up in 2040?”

Source: SMF expert survey; n=8. Mean, maximum, minimum and quartiles displayed.

Figure 2: “What share of the global meat market will alternative proteins hold in 2040 under the following scenarios?”

Source: SMF expert survey; n=8. Mean, maximum, minimum and quartiles displayed

Contact

For media enquiries, please contact press@smf.co.uk