Housing Secretary Michael Gove risks renters’ rights and wellbeing by delaying a ban on no-fault evictions based on false claims that Britain’s rental sector would collapse, a think tank warns.

International evidence and Scotland’s experience of banning no fault evictions shows that the measure would not harm the rental sector by prompting landlords to leave the market, and might actually enable it to grow said the Social Market Foundation, a cross-party think tank.

DLUHC secretary Michael Gove’s delayed the Conservative’s 2019 commitment to ban no-fault evictions, which currently allow landlords to evict tenants without establishing faults. Multiple Conservative MPs claimed that banning the practice would cause landlords to exit the market, decreasing the supply of rental housing at a time of high demand.[i] Through the King’s Speech, the Government confirmed that Section 21 “no-fault” evictions will not be brought in until a new court process and stronger possession grounds for landlords are in place.

Yet SMF analysis of other places that have ended no-fault evictions found little evidence to suggest it had a negative effect.

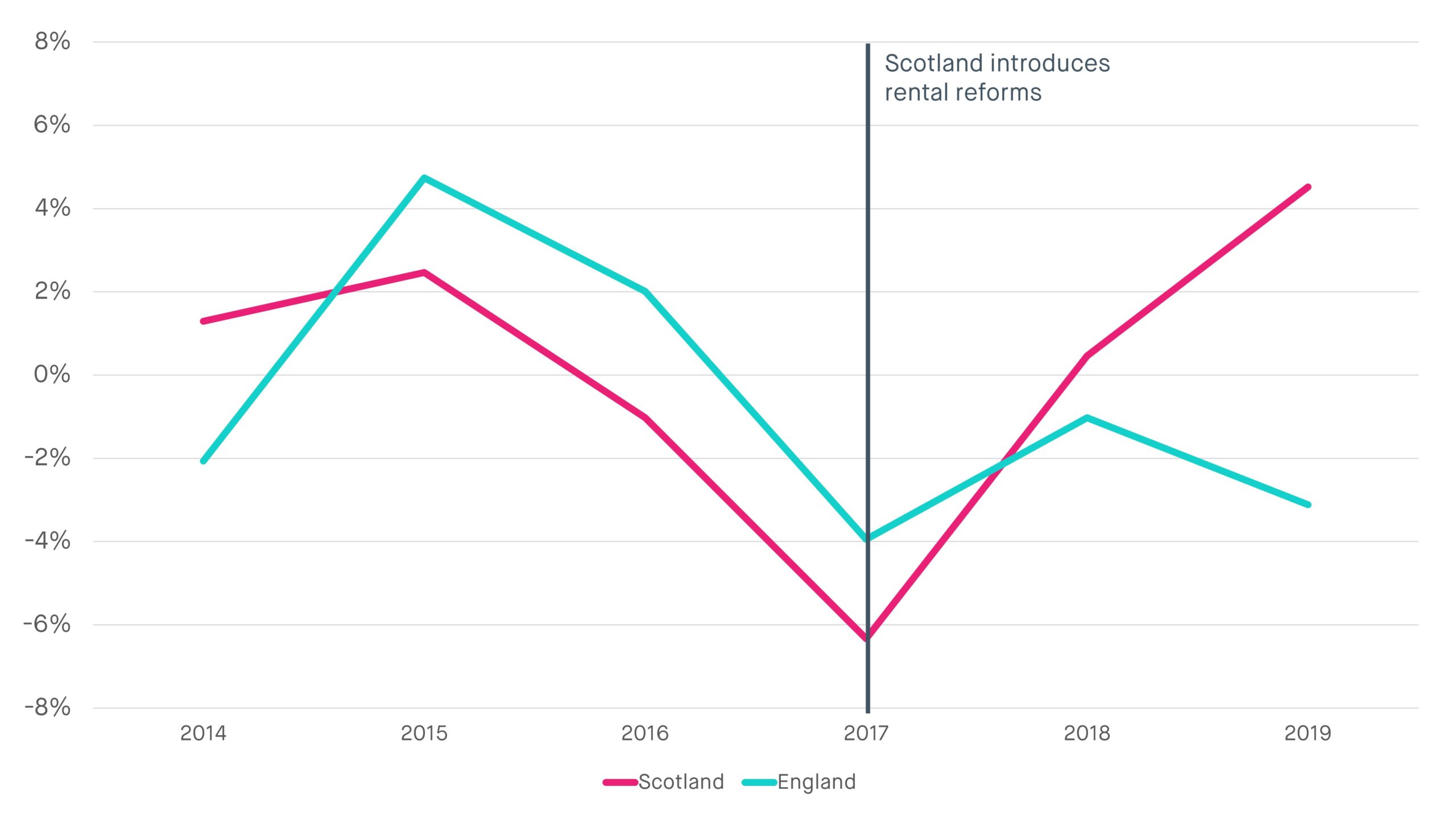

The Scottish Parliament effectively banned no-fault evictions in 2017, yet its private rented sector grew at a faster rate between March 2018 and March 2020 than England’s. The two had been following similar trends up to that point.

This is especially striking as Scotland’s ban on no-fault evictions occurred at the same time as large-scale protections for renters were introduced.[ii] In comparison to Gove’s plan, these changes made renting far more burdensome for landlords, yet were followed by an expansion of the market.

In 2019, Scotland saw its private rented sector grow at its fastest rate since 2011, while England’s continued to shrink. (See notes)

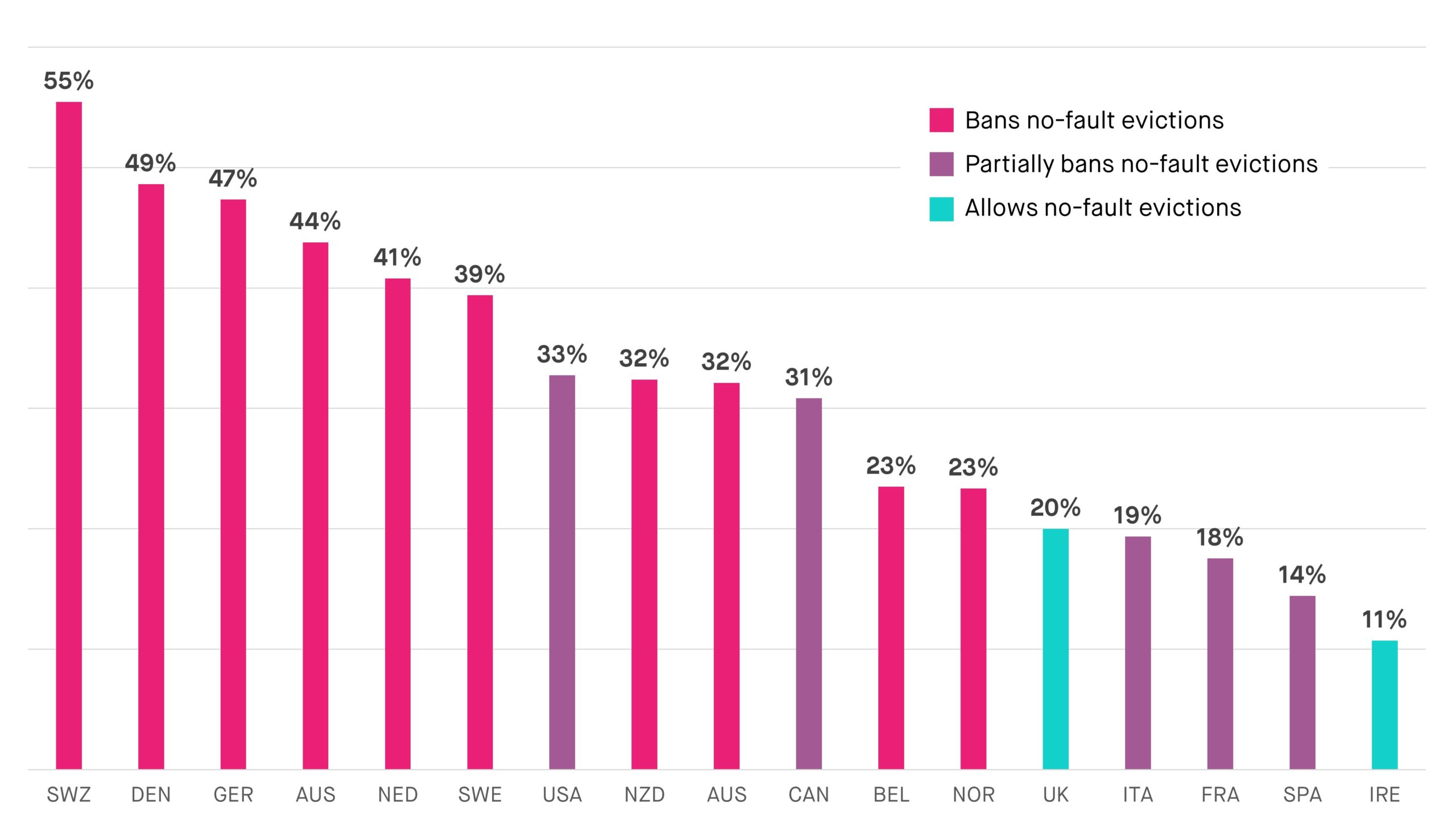

The SMF also looked at evidence from other similar economies to the UK that have some kind of restriction on no-fault evictions.

European countries that ban no-fault evictions tend to have a larger private rented sector. Switzerland, Denmark, Germany, Austria, and the Netherlands all have twice as large a rented sector as the UK while banning no-fault evictions.

Within United States and Canada, which also have larger rented sectors than the UK, the practice is often banned by states or provinces, for example in California and Quebec.

Italy, France and Spain have smaller private rented sectors than the UK, and allow for no fault evictions in specified circumstances, such as when the landlord moves into the property. Ireland, the only large European economy that allows no-fault evictions, has one of the smallest rental sectors.

This may be self-reinforcing: as a country gets more renters, their voice grows stronger allowing them to lobby for greater protections which further increase demand, the SMF said.

Gideon Salutin, SMF Researcher, said:

“The argument that the rental sector will contract under regulations which protect renters is based on faulty economics which ignore the role renters play in the market.”

“There appears to be no correlation between an increase in rental protections and a decrease in rental properties. In fact, the opposite may be true, as stronger protections attract more renters, increasing demand and normalising renting over the long term.”

Notes

Figure 1: Percentage increase in the share of households which are rented privately

Source: Scottish Household Survey and English Housing Survey

Figure 2: Share of households in the private rented sector by country and eviction regulations

Source: OECD Housing Market Database

Contact

- For media enquiries, please contact press@smf.co.uk

ENDS

[i] See, for example, https://www.politicshome.com/news/article/tory-mp-believes-scrapping-section-21-leave-thousands-homeless and https://www.thetimes.co.uk/article/michael-gove-no-fault-evictions-ban-tory-rebellion-hjqr07tmq

[ii] These include introducing open-ended tenancies, limits to the frequency of rent increases, a new public officer capable of restricting rent increases if they consider them unreasonable, longer notices to vacate, and the potential for local caps on rent increases.