The impact of audit services are far reaching, potentially affecting millions of everyday consumers through their jobs, pensions, investments, savings and public services.

The audit market has been under increased scrutiny, particularly since the unfolding developments of firms such as Carillion and BHS in recent years. These examples gained widespread media coverage, bringing audit-related issues to the public’s attention. However, even though we have seen how damaging the consequences of failure can be, there can still sometimes seem to be a disconnect between audit and the everyday lives of consumers.

We know that government and policymakers are taking action. The Kingman review has delivered recommendations on the Financial Reporting Council (FRC), calling for it to be replaced with an independent statutory regulator, and the Competition and Markets Authority (CMA) are consulting on final recommendations for their market study on audit services. However, the topic of audit can be technical, and the broader value of audit as a public good may not always be clear to consumers.

It is the responsibility of auditors to ensure that company information is accurate and trustworthy. Otherwise, firms can conceal financial trouble. That can have repercussions for employees, investors, suppliers and taxpayers. However, there can be an “expectations gap”, where there is a difference between what the public or stakeholders expect audits to do, and what audits are required to do. One example is distinguishing between the role of auditors and company directors in safeguarding of the company.

Private limited companies must be audited, unless they qualify for an exemption. They are exempt if they satisfy 2 out of the 3 following conditions: annual turnover of no more than £10.2m, assets worth no more than £5.1m and 50 or fewer employees on average. Public and state-owned companies also must be audited.

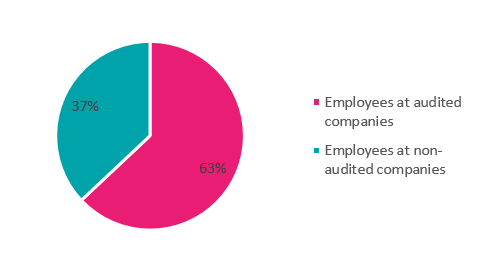

Around 14 million people – over 60% of private sector employees – work for audited companies. These have a combined turnover of £2.4 trillion, accounting for more than 60% of the turnover of private sector businesses.[i] If a company is providing incorrect financial information and this is not picked up by auditors, this can put the jobs of employees at risk, particularly if it leads to a more abrupt company failure.

Employees working at audited private companies

Source: SMF analysis of business population estimates 2018

Employees are also exposed to company failures through defined benefit pension schemes. We have seen high-profile examples of this, such as the 19,000 members of the BHS pension scheme who will not receive the retirement income they earned and were promised. A recent FRC report found issues with the way pensions were reviewed in nearly half of their sample of audits.[ii] Large shares of pension funds are invested into the UK economy, and due to auto-enrolment, the majority of employees are now exposed to this.

Incorrect company information can also mislead investors to make certain decisions. Those investors include 11% of households, who own UK shares worth a total of £250bn.[iii] There is also the broader impact on confidence in the economy; the market value of UK listed public companies (which are all audited) is approximately £4.2 trillion.[iv]

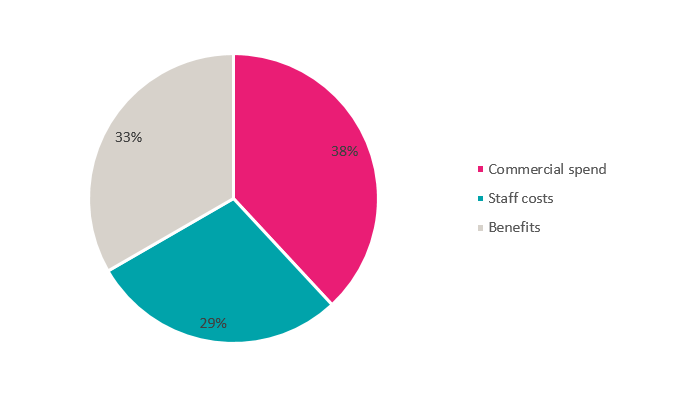

Spending on contracts accounts for one-third of government expenditure

Source: NAO, Commercial and contracting (2018)

In addition, both local and central government are increasingly reliant on contracting out essential services, consisting of one-third of government expenditure. The government spent 13.7% of GDP on public procurement in 2015-16[v], ranging from health and transport to prison services. As we saw with the fallout of Carillion, these services were plunged into uncertainty and funded by the Cabinet Office until alternative suppliers were found.[vi]

The success or failure of audit can have significant impact on the public, as consumers, employees, investors and taxpayers. It is essential that the market works well to provide good quality audits, and ultimately protect the wider public. The CMA’s recommendations are working towards this, particularly through improving competition and the quality of audits. Another key factor is what the remit of audit should include, so we welcome the Audit Quality Forum’s forthcoming review of the “expectations gap”. Ultimately, audit is a societal good, and the expectations of the public and stakeholders should be taken into account when defining the remit of auditors.

[i] Private limited companies qualify for an audit exemption if they satisfy 2 out of the 3 following conditions: annual turnover of no more than £10.2m, assets worth no more than £5.1m and 50 or fewer employees on average

[ii] FRC, Audit of defined benefit pension obligations (2018)

[iii] https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/incomeandwealth/datasets/financialwealthwealthingreatbritain

[iv] As at May 2017 https://www.frc.org.uk/frc-for-you/the-frc-in-numbers

[v] House of Commons, After Carillion: Public sector outsourcing and contracting (2018)

[vi] NAO, Investigation into the government’s handling of Carillion (2018)