The UK has had an exports problem since the financial crisis of 2008, further compounded by the COVID-19 pandemic. In this report, we show that e-commerce should be a key focus of trade policy effort as it offers a route to get more small and medium-sized enterprises (SMEs) exporting, and how to remove the barriers they face.

KEY POINTS

- After the 2008 financial crisis, the UK has struggled to grow its goods exports at a similar rate to before 2008. By the end of 2019, there was a 26% shortfall between where goods exports would have been had previous trends continued and the actual position.

- The COVID-19 pandemic has exacerbated this problem, such that the UK’s goods exports were 21% lower in mid-2022 than December 2019. By contrast, by mid-2022, world goods exports were 7.9% higher than at the end of 2019, while in advanced economies they were 3.5% higher.

- E-commerce offers opportunities for non-exporting SMEs and for existing exporting SMEs to expand.

- Online marketplaces provide a number of particular advantages as a route to overseas markets, including:

- Increasing the trust in sellers, among customers

- Reducing the risks associated with cross-border payments

- Making it easier to resolve problems with customers

- Saving firms time and money on some of the costs associated with exporting (e.g., setting up distribution networks and marketing in other countries)

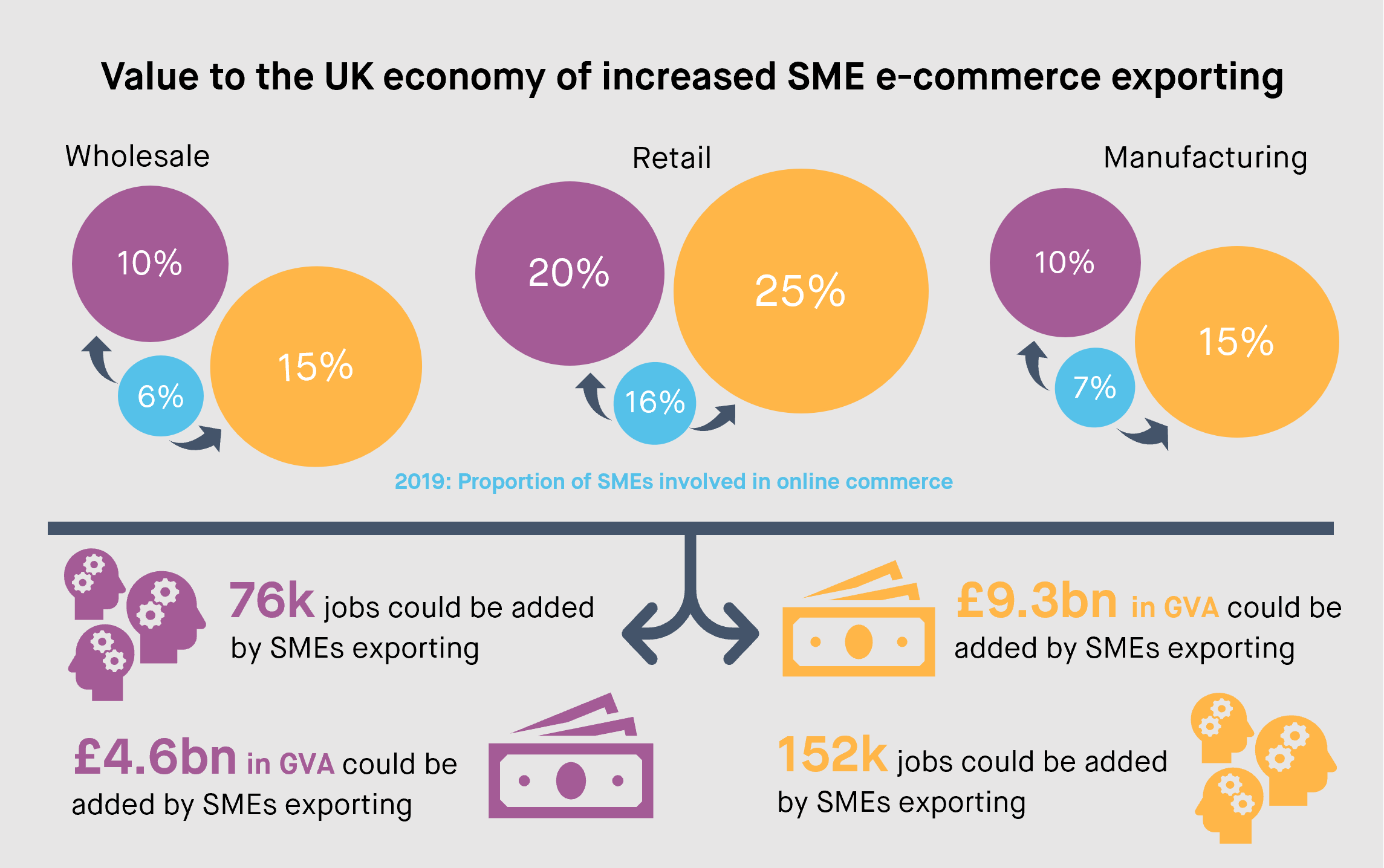

- Increasing the proportion of SME retail, wholesale and manufacturing businesses that are e-commerce exporters could deliver considerable benefits to the UK economy. We’ve estimated that:

Source: SMF analysis

- There is evidence that government support for exporting can make some difference to a firm’s export success. However, for it to drive the scale of change needed, the current UK export strategy will need to reach out to SMEs more to an extent few initiatives have managed previously. Evidence from in-depth interviews with SMEs revealed a very mixed picture. Some owner-managers had not encountered any of the governments advice and were sceptical about the Department for International Trade’s (DIT) ability to deliver to them anything useful. One business-owner that had found a DIT training course about websites useful to their business. However, they only found out about it accidentally, through their workplace.

Recommendations

In order to help tackle some of the key obstacles to SMEs exporting and e-commerce exporting in particular, we recommend a range of policy measures that government can take:

- Domestic:

- Ensure trade e-commerce and digital trade policy is coherent and coordinated across the myriad of departments that have an interest in these areas by setting up an Office for E-Commerce and Digital Trade (OE-CDT) to ensure these conditions are present.

- A package of measures to encourage “experimenting” with exporting by SMEs, with initiatives such as a “starting exporting” grant scheme and an expansion of the Help to Grow: Digital scheme to provide more support for firms to pursue cross-border digital trade opportunities.

- An overhaul of DITs and HMRC web presence around exporting so that it is more small business friendly.

- International:

- The UK Government should push for agreement on and the ratification of the nascent e-commerce agreement under the auspices of the WTO, alongside arguing for the unique needs of SMEs to become a central organising principle of WTO activity.

- Negotiate for de minimis customs thresholds in trade agreements as well “informal entry” customs processes for low-value trade, modelled on the US approach, if a rigorous evaluation suggests the US experience has delivered benefits.

- Work to incorporate best-in-class SME and e-commerce chapters into all future trade treaties with other countries.